-

Hello Kitty Pop-Up Torrance

Hello Kitty Pop-Up Torrance

Sanrio Retail Installation by Coffee House Industries -

MICHAEL WAY'S IMMERSIVE THREE-DIMENSIONAL SOUND EXPERIENCE REVOLUTIONIZES MUSIC VIDEOS, LIVE THEATER, AND THE FUTURE OF CONTENT DEVELOPMENT

MICHAEL WAY'S IMMERSIVE THREE-DIMENSIONAL SOUND EXPERIENCE REVOLUTIONIZES MUSIC VIDEOS, LIVE THEATER, AND THE FUTURE OF CONTENT DEVELOPMENT -

Winter 2025 Newsletter

Winter 2025 Newsletter -

NEW ERA OF INDEPENDENT FILMMAKING IN ATLANTA

NEW ERA OF INDEPENDENT FILMMAKING IN ATLANTA -

Retreat to the Mountain, Return to Yourself

Retreat to the Mountain, Return to Yourself -

Coffee House Industries Builds the First McLaren x Allwyn "Scratch Car" in Collaboration with Designer Florian Weber

Coffee House Industries Builds the First McLaren x Allwyn "Scratch Car" in Collaboration with Designer Florian Weber -

Five most common mistakes made by Producers......and how to avoid them!

Five most common mistakes made by Producers......and how to avoid them! -

Malibu Autobahn Puts Its Armored Truck to the Test

Malibu Autobahn Puts Its Armored Truck to the Test -

Announcing the BVA Final 2025 Auction!

Announcing the BVA Final 2025 Auction! -

New Arrivals

New Arrivals -

SmartSource Los Angeles Expands to New Facility

SmartSource Los Angeles Expands to New Facility -

Shoot Aviation Widebody for Apple TV's PLURIBUS

Shoot Aviation Widebody for Apple TV's PLURIBUS -

4Wall & Metro Media Productions Illuminate CNA's Global Nurses Solidarity Assembly

4Wall & Metro Media Productions Illuminate CNA's Global Nurses Solidarity Assembly -

The Lot at Formosa Wins Corporate Innovation Award

The Lot at Formosa Wins Corporate Innovation Award -

Coffee House Industries Brings MOONBOOT at ComplexCon Las Vegas

Coffee House Industries Brings MOONBOOT at ComplexCon Las Vegas -

The Board Patrol now carries Sand & Grass Protectors

The Board Patrol now carries Sand & Grass Protectors -

National Set Medics Celebrates 10 Years of Service!

National Set Medics Celebrates 10 Years of Service! -

Fall Newsletter

Fall Newsletter

Production News & Events -

In Memory of Otto Nemenz

In Memory of Otto Nemenz

(1941-2025)

A Legacy That Shaped Cinema -

Submissions are Now Open for the Society of Camera Operators (SOC) Camera Operator of the Year Film and Television and will Open November 5th for Technical Achievement Awards

Submissions are Now Open for the Society of Camera Operators (SOC) Camera Operator of the Year Film and Television and will Open November 5th for Technical Achievement Awards -

4Wall & GPJ Transform Domino Park for Historic Jeep Cherokee 2026 Reveal By 4Wall Entertainment

4Wall & GPJ Transform Domino Park for Historic Jeep Cherokee 2026 Reveal By 4Wall Entertainment -

GALPIN IS PROUD TO INTRODUCE OUR

GALPIN IS PROUD TO INTRODUCE OUR

NEW Production Supply Manager

John Vargas -

-

WonderWorks - Gateway To The Stars

WonderWorks - Gateway To The Stars -

WLA3D Produces Large Scale Models for Company Launch

WLA3D Produces Large Scale Models for Company Launch -

United Rentals Tool Solutions Powers Film & Production Communications

United Rentals Tool Solutions Powers Film & Production Communications -

-

Coffee House Industries Helps Bring Six Flags Fright Fest to Life

Coffee House Industries Helps Bring Six Flags Fright Fest to Life -

-

Newel Props, Film and TV Set Rentals in New York

Newel Props, Film and TV Set Rentals in New York -

From store racks to your home screen...

From store racks to your home screen...

Iguana Vintage Clothing is LIVE on WhatNot! -

-

Welcome to TCP Insurance: Trusted Coverage for the Creative Community

Welcome to TCP Insurance: Trusted Coverage for the Creative Community -

-

From Sketch to Spotlight: Coffee House Industries Brings the Canelo vs. Crawford Belt Display to Life in Record Time

From Sketch to Spotlight: Coffee House Industries Brings the Canelo vs. Crawford Belt Display to Life in Record Time -

The 25th Annual Valley Festival is Here Again

The 25th Annual Valley Festival is Here Again -

The Lot at Formosa: A Storied Studio's Next Chapter Unfolds

The Lot at Formosa: A Storied Studio's Next Chapter Unfolds -

2025 EMERGING CINEMATOGRAPHER AWARDS - LOS ANGELES!

2025 EMERGING CINEMATOGRAPHER AWARDS - LOS ANGELES! -

Producers are going BIG with Reel Monster Trucks

Producers are going BIG with Reel Monster Trucks -

-

-

-

California Rent A Car's Studio Division celebrates its 20th anniversary!

California Rent A Car's Studio Division celebrates its 20th anniversary! -

Showbiz Restrooms Brings Luxury to the Film Industry

Showbiz Restrooms Brings Luxury to the Film Industry -

FILM READY AVIATION MOCKUPS

FILM READY AVIATION MOCKUPS -

Here we Grow Again

Here we Grow Again -

From Blueprint to Reality: Heck Yeah Productions Unveils 5,000 Sq. Ft. Event and Recording Space

From Blueprint to Reality: Heck Yeah Productions Unveils 5,000 Sq. Ft. Event and Recording Space -

Quixote Provides Solar Power, Shared Smarter

Quixote Provides Solar Power, Shared Smarter -

Lights! Camera! aaaand GOLDENS at All Animal Actors International

Lights! Camera! aaaand GOLDENS at All Animal Actors International -

Baldwin Production Services San Francisco nominated for 2025 Cola Award

Baldwin Production Services San Francisco nominated for 2025 Cola Award -

Summer 2025 Newsletter

Summer 2025 Newsletter -

Keep Production in LA Industry Mixer Thursday Aug 21, 2024

Keep Production in LA Industry Mixer Thursday Aug 21, 2024 -

Creative Handbooks to be Given Out at the Upcoming Location Managers Guild International Awards

Creative Handbooks to be Given Out at the Upcoming Location Managers Guild International Awards -

-

Cape Town, Music Curation, Shout out & Podcast Interview VAMO

Cape Town, Music Curation, Shout out & Podcast Interview VAMO -

Get One-Stop Shopping on Fabric Printing & Borderless Framing

Get One-Stop Shopping on Fabric Printing & Borderless Framing -

OpenAI's New Browser Could Change the Internet Forever

OpenAI's New Browser Could Change the Internet Forever -

Malibu Autobahn Rolls Through LA with Joseline Hernandez for Zeus Network

Malibu Autobahn Rolls Through LA with Joseline Hernandez for Zeus Network -

Studio Animal Services, LLC - Kittens Available for Production

Studio Animal Services, LLC - Kittens Available for Production -

Wireless Teleprompter Rig Takes to the Streets of Midtown Manhattan

Wireless Teleprompter Rig Takes to the Streets of Midtown Manhattan -

-

New Everyday Low Prices on Rigging Hardware Take a Look at 20% Lower Prices on Average

New Everyday Low Prices on Rigging Hardware Take a Look at 20% Lower Prices on Average -

Westside Digital Mix: Venice Edition

Westside Digital Mix: Venice Edition -

Film in Palmdale

Film in Palmdale

Scenic Locations, Valuable Incentives -

Los Angeles Properties for

Los Angeles Properties for

Filming, Events, Activations

Pop Ups and Photo -

Burbank Stages can now be painted any color to match

Burbank Stages can now be painted any color to match -

Custom Prop Rentals: Bringing Your Dream Event to Life with Life-Size Magic

Custom Prop Rentals: Bringing Your Dream Event to Life with Life-Size Magic -

New Arrivals

New Arrivals -

-

Studio Wings moves offices, flight operations and aircraft to the Santa Fe Airport

Studio Wings moves offices, flight operations and aircraft to the Santa Fe Airport -

WeCutFoam Specializes in Fabrication of Signs, Logos and Letters for Company Summits

WeCutFoam Specializes in Fabrication of Signs, Logos and Letters for Company Summits -

Studio Tech Provides Wi-Fi And Internet for The Superman Movie Press Junket

Studio Tech Provides Wi-Fi And Internet for The Superman Movie Press Junket -

Superman movie Press Junket @ Buttercup Venues

Superman movie Press Junket @ Buttercup Venues -

Honoring Stories Worth Telling Since 2009

Honoring Stories Worth Telling Since 2009

All Ages - All Cultures - All Media -

Xenia Lappo Joins ESTA as New Program Manager for Membership & Events

Xenia Lappo Joins ESTA as New Program Manager for Membership & Events -

Nathan Wilson and Chris Connors discuss creating for children's television with ZEISS Supreme Prime lenses

Nathan Wilson and Chris Connors discuss creating for children's television with ZEISS Supreme Prime lenses -

Luxury Solar Restroom Trailer Sustainability

Luxury Solar Restroom Trailer Sustainability -

Midwest Rigging Intensive Returns with Touring Rigging Theme

Midwest Rigging Intensive Returns with Touring Rigging Theme -

Custom Pool Floats That Steal the Show

Custom Pool Floats That Steal the Show -

Malibu Autobahn Dresses Coachella 2025 for Shoreline Mafia

Malibu Autobahn Dresses Coachella 2025 for Shoreline Mafia -

Thunder Studios Wins Nine 2025 Telly Awards

Thunder Studios Wins Nine 2025 Telly Awards -

-

LCW Props Is Your One Stop Prop Shop

LCW Props Is Your One Stop Prop Shop -

Venues in Los Angeles for Activations and Filming

Venues in Los Angeles for Activations and Filming -

-

-

Honoring Stories Worth Telling Since 2009 - All Ages - All Cultures - All Media

Honoring Stories Worth Telling Since 2009 - All Ages - All Cultures - All Media -

Buttercup Venues Accepting Submissions to Help Property Owners Monetize Their Spaces

Buttercup Venues Accepting Submissions to Help Property Owners Monetize Their Spaces -

Studio Animal Services Stars in Latest Fancy Feast Commercial

Studio Animal Services Stars in Latest Fancy Feast Commercial -

WDM celebrates Summer at the famed Michael's Santa Monica

WDM celebrates Summer at the famed Michael's Santa Monica -

Studio Technical Services Inc.

Studio Technical Services Inc.

Spring 2025 Newsletter -

From Call to Setup: Coffee House Industries Lights Up Netflix Is a Joke at the Avalon

From Call to Setup: Coffee House Industries Lights Up Netflix Is a Joke at the Avalon -

WLA3D produces scale model for Fox Grip

WLA3D produces scale model for Fox Grip -

Filming Locations and Event Venues Los Angeles

Filming Locations and Event Venues Los Angeles -

Scenic Expressions Launches a Full-Service Liquidation Solution for the Film & TV Industry

Scenic Expressions Launches a Full-Service Liquidation Solution for the Film & TV Industry -

Producers Need Reel Monster Trucks for Reel Productions

Producers Need Reel Monster Trucks for Reel Productions -

Meet Michael Way | Engineer

Meet Michael Way | Engineer -

In Development: ZEISS Virtual Lens Technology Elevating VFX with physically based lens effects

In Development: ZEISS Virtual Lens Technology Elevating VFX with physically based lens effects -

(2) PREMIER AV ACTIONS

(2) PREMIER AV ACTIONS -

RSVP - 80 Films & Tech - Meet the Visionaries - EMMY, Telly, Peabody winners and more

RSVP - 80 Films & Tech - Meet the Visionaries - EMMY, Telly, Peabody winners and more -

New Arrivals Are Here - Check Out LMTreasures.com

New Arrivals Are Here - Check Out LMTreasures.com -

Film-Friendly Retail Space at Tejon Outlets

Film-Friendly Retail Space at Tejon Outlets -

Behind Every Great Production, There's a Great Move

Behind Every Great Production, There's a Great Move -

Buttercup Venues' recent work with Invisible Dynamics & Blue Revolver

Buttercup Venues' recent work with Invisible Dynamics & Blue Revolver -

Join ZEISS Cinema at this year's NJ Film Expo on Thursday, May 1

Join ZEISS Cinema at this year's NJ Film Expo on Thursday, May 1 -

The Location Managers Guild International (LMGI) announces that its 12th Annual LMGI Awards Show will be held on Saturday, August 23, 2025

The Location Managers Guild International (LMGI) announces that its 12th Annual LMGI Awards Show will be held on Saturday, August 23, 2025 -

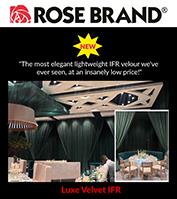

Get Your Production Supplies Now While Prices Are Stable*

Get Your Production Supplies Now While Prices Are Stable*

Rose Brand Is Your One Stop Shop -

Immersive Sound for your next production from TrueSPL

Immersive Sound for your next production from TrueSPL -

WeCutFoam Fabricating Large Scale Props and Decor for Companies & Products Launching Events

WeCutFoam Fabricating Large Scale Props and Decor for Companies & Products Launching Events -

The "CA-Creates" eGroup Network

The "CA-Creates" eGroup Network -

The Location Managers Guild International Announces the Newly Elected 2025 LMGI Board of Directors

The Location Managers Guild International Announces the Newly Elected 2025 LMGI Board of Directors -

Production Moves: How to Find the Most Qualified Mover

Production Moves: How to Find the Most Qualified Mover -

SAG-AFTRA Talent Payments @ Production Payroll Services

SAG-AFTRA Talent Payments @ Production Payroll Services -

-

-

New Everyday Low Prices on Rigging Hardware

New Everyday Low Prices on Rigging Hardware

Take a Look at 20% Lower Prices on Average -

Tejon Ranch introduces its Premium Ranch Cabins

Tejon Ranch introduces its Premium Ranch Cabins -

Our Enchanting Garden Collection is Growing!

Our Enchanting Garden Collection is Growing! -

-

-

Top Entertainment CEOs & Industry Titans Join Forces for Groundbreaking New Media Film Festival®

Top Entertainment CEOs & Industry Titans Join Forces for Groundbreaking New Media Film Festival® -

Tejon Ranch opens Diner location for your next Production

Tejon Ranch opens Diner location for your next Production -

Discover the Performance of ZEISS Otus ML

Discover the Performance of ZEISS Otus ML

Deep Dive into the Features and Technology -

Universal Animals cast the dog in Anora!

Universal Animals cast the dog in Anora! -

Burbank Stages is Now Open with upgraded support space

Burbank Stages is Now Open with upgraded support space -

-

Buttercup Venues Grows Portfolio with Exciting New Locations for Filming and Events

Buttercup Venues Grows Portfolio with Exciting New Locations for Filming and Events -

Fashion District Suite 301

Fashion District Suite 301 -

Something new is coming for Photographers

Something new is coming for Photographers

Mark Your Calendar - February 25th -

WLA3D completes scale model of vintage Knott's Berry Farm attraction

WLA3D completes scale model of vintage Knott's Berry Farm attraction -

New Media Film Festival has invited you to submit your work via FilmFreeway!

New Media Film Festival has invited you to submit your work via FilmFreeway! -

WeCutFoam Collaborated Once More with Children's Miracle Network Hospitals

WeCutFoam Collaborated Once More with Children's Miracle Network Hospitals -

-

EigRig SLIDE-R1 Revolutionizes Filmmaking Production with Innovation

EigRig SLIDE-R1 Revolutionizes Filmmaking Production with Innovation -

-

-

-

Practicals Rental Lighting Welcomes the Jucolor UV Flatbed Printer

Practicals Rental Lighting Welcomes the Jucolor UV Flatbed Printer -

GBH Maintenance Inc. Has Grown

GBH Maintenance Inc. Has Grown -

The Rarest Stars Shine Brightest

The Rarest Stars Shine Brightest -

Affected by the ongoing California wildfires

Affected by the ongoing California wildfires -

Get One-Stop Shopping...

Get One-Stop Shopping... -

Buttercup Venues Expands

Buttercup Venues Expands -

-

Los Angeles Office Spaces: Versatile Backdrops for Filming

Los Angeles Office Spaces: Versatile Backdrops for Filming -

All Creatures Great and small holiday commercial for Montefiore hospital

All Creatures Great and small holiday commercial for Montefiore hospital -

DEEP CLEANS WAREHOUSE FOR SUPER BOWL COMMERCIAL

DEEP CLEANS WAREHOUSE FOR SUPER BOWL COMMERCIAL -

New Production Hub in Los Angeles

New Production Hub in Los Angeles -

Carlos R. Diazmuñoz

Carlos R. Diazmuñoz -

WeCutFoam Specializes in Decor

WeCutFoam Specializes in Decor -

Studio Technical Services Inc.

Studio Technical Services Inc.

Fall 2024 Update -

New Media Film Festival has invited you to submit your work

New Media Film Festival has invited you to submit your work -

-

Available again!

Available again!

Studio 301 - 16,000 Sq. Ft. -

Elevate Your Production with SoundPressure Labs'

Elevate Your Production with SoundPressure Labs' -

Pro-Cam expands rental operation...

Pro-Cam expands rental operation... -

NATIONAL ASSOCIATION OF LATINO INDEPENDENT PRODUCERS

NATIONAL ASSOCIATION OF LATINO INDEPENDENT PRODUCERS -

New Sony A9 III Reviews

New Sony A9 III Reviews -

New, Heavyweight, Lustrous, Shimmering 56" Elana IFR Fabric

New, Heavyweight, Lustrous, Shimmering 56" Elana IFR Fabric -

JOIN US IN ORLANDO THIS NOVEMBER!

JOIN US IN ORLANDO THIS NOVEMBER! -

BLUE MOON CLEANING

BLUE MOON CLEANING

RESTORES MUSIC-MAKING -

Another Collaboration Between WeCutFoam and Event Planner

Another Collaboration Between WeCutFoam and Event Planner -

BLUE MOON CONGRATULATES 2024 COLA FINALISTS

BLUE MOON CONGRATULATES 2024 COLA FINALISTS -

Fall Production News & Events

Fall Production News & Events -

Not just green, but mighty Verde

Not just green, but mighty Verde -

Introducing...

Introducing...

Restaurant/Bar/Venue in Encino -

-

ESTA and Earl Girls, Inc. Launch $100,000 TSP Fundraising Challenge

ESTA and Earl Girls, Inc. Launch $100,000 TSP Fundraising Challenge -

There's still time to register for ESTA's Plugfest

There's still time to register for ESTA's Plugfest -

-

BLUE MOON CLEANING SEES SPIKE IN MAJOR LA FEATURE FILMING

BLUE MOON CLEANING SEES SPIKE IN MAJOR LA FEATURE FILMING -

Amoeba Records on Sunset

&

SuperMarket in K-Town -

"Alice in Wonderland" tea party brought to life...

"Alice in Wonderland" tea party brought to life... -

Filming With Production Ready Aviation Equipment

Filming With Production Ready Aviation Equipment -

-

-

A5 Events - Take Your Event to The Next Level

A5 Events - Take Your Event to The Next Level -

The Original Amoeba Records Venue

The Original Amoeba Records Venue

& The SuperMarket -

Doc Filmmaker Jennifer Cox

Doc Filmmaker Jennifer Cox -

Red, White or Blue Rental Drapes

Red, White or Blue Rental Drapes -

Introducing Tuck Track Invisible Framing for Fabric Prints

Introducing Tuck Track Invisible Framing for Fabric Prints -

-

American Movie Company's LED Wall Studio Sale

American Movie Company's LED Wall Studio Sale -

Black 360 Independence Studio

Black 360 Independence Studio -

Nominations are open for the 2025 ESTA Board of Directors!

Nominations are open for the 2025 ESTA Board of Directors! -

Custom Prop Rentals is moving to a new, larger location!

Custom Prop Rentals is moving to a new, larger location! -

Pro-Cam opens Las Vegas branch, expanding rental operation

Pro-Cam opens Las Vegas branch, expanding rental operation -

New ShowLED Starlight Drops

New ShowLED Starlight Drops -

Costume House Sidewalk Sale

Costume House Sidewalk Sale -

Working Wildlife's newly renovated 60 acre ranch available for Filming

Working Wildlife's newly renovated 60 acre ranch available for Filming -

Location Manager Bill Bowling

Location Manager Bill Bowling

to Receive the Trailblazer Award -

-

Mr. Location Scout is in Lake Tahoe

Mr. Location Scout is in Lake Tahoe -

DreamMore Resort Fountain

DreamMore Resort Fountain -

Valley Film Festival

Valley Film Festival

Greetings from the (818): -

2024 Changemaker Awards and Artist Development Showcase

2024 Changemaker Awards and Artist Development Showcase -

ZEISS Conversations with Jack Schurman

ZEISS Conversations with Jack Schurman -

Collaboration Between WeCutFoam and Yaamava Resort & Casino

Collaboration Between WeCutFoam and Yaamava Resort & Casino -

Location Managers Guild International Awards

Location Managers Guild International Awards -

Molding Cloth

Molding Cloth

Make Fabulous Textured Designs -

WeCutFoam Specializes in Large Events

WeCutFoam Specializes in Large Events -

Introducing Truck Track Invisible Framing for Fabric Prints

Introducing Truck Track Invisible Framing for Fabric Prints -

GBH Maintenance is back at Herzog Wine Cellars

GBH Maintenance is back at Herzog Wine Cellars -

SATE NORTH AMERICA 2024

SATE NORTH AMERICA 2024 -

Production News & Events Summer Edition

Production News & Events Summer Edition -

Four Amazing Architectural Locations!

Four Amazing Architectural Locations! -

* BIG SAVINGS * ON BIG STUDIOS

* BIG SAVINGS * ON BIG STUDIOS -

Let Your Brand Stand Tall!

Let Your Brand Stand Tall! -

Sue Quinn to Receive Lifetime Achievement Award

Sue Quinn to Receive Lifetime Achievement Award -

ZEISS Cinema at Filmscape Chicago

ZEISS Cinema at Filmscape Chicago -

GBH Maintenance Is the Standard for Commercial Maintenance

GBH Maintenance Is the Standard for Commercial Maintenance -

Come Join Us at Cine Gear Expo 2024

Come Join Us at Cine Gear Expo 2024 -

Available now:

Available now:

6th Street Gallery & Venue -

Thunder Studios Triumphs with Five Telly Awards

Thunder Studios Triumphs with Five Telly Awards -

Reddit Went Public IPO - WeCutFoam Was There With Decor

Reddit Went Public IPO - WeCutFoam Was There With Decor -

AirDD's Hottest New Product

AirDD's Hottest New Product

for 2024 Events -

GBH Maintenance Sets the Standard for Window Cleaning

GBH Maintenance Sets the Standard for Window Cleaning -

Haigwood Studios collaboration with the UGA Dodd School of Art

Haigwood Studios collaboration with the UGA Dodd School of Art -

-

RX GOES TO 11!

RX GOES TO 11!

with Mike Rozett -

Don't Be A Square - Think Outside The Box!!

Don't Be A Square - Think Outside The Box!! -

WeCutFoam Fabricates Realistic Lifesize Props

WeCutFoam Fabricates Realistic Lifesize Props -

-

Exposition Park Stage/Venue

Exposition Park Stage/Venue -

Production Update From UpState California Film Commission

Production Update From UpState California Film Commission -

Base Camp With All The Extras

Base Camp With All The Extras -

LAPPG AT THE ZEISS CINEMA SHOWROOM

LAPPG AT THE ZEISS CINEMA SHOWROOM -

ZEISS Nano Primes and ZEISS CinCraft Scenario Received NAB Show 2024

ZEISS Nano Primes and ZEISS CinCraft Scenario Received NAB Show 2024 -

Cranium Camera Cranes Introduces the all new Tankno Crane!

Cranium Camera Cranes Introduces the all new Tankno Crane! -

Come Join Us at Cine Gear Expo 2024

Come Join Us at Cine Gear Expo 2024 -

FAA Drill Burbank Airport

FAA Drill Burbank Airport

(federal aviation administration) -

Exclusive Stahl Substitute Listing from Toni Maier-On Location, Inc.

Exclusive Stahl Substitute Listing from Toni Maier-On Location, Inc. -

GBH Maintenance: Elevating Janitorial Standards Across Los Angeles

GBH Maintenance: Elevating Janitorial Standards Across Los Angeles -

LOCATION CONNECTION has the best RANCHES FOR FILMING!

LOCATION CONNECTION has the best RANCHES FOR FILMING! -

Hollywood Studio Gallery has Moved

Hollywood Studio Gallery has Moved -

AirDD's inflatable "Kraken" designs transformed Masked Singers

AirDD's inflatable "Kraken" designs transformed Masked Singers -

GBH maintenance Provided a Hollywood Shine for Herzog Wine Cellars

GBH maintenance Provided a Hollywood Shine for Herzog Wine Cellars -

Production News & Events

Production News & Events

Spring Newsletter -

Immersive Venue/ Black Box/ Stage

Immersive Venue/ Black Box/ Stage

2024 DTLA Arts District -

-

Exclusive Malibu Listing from Toni Maier - On Location, Inc.

Exclusive Malibu Listing from Toni Maier - On Location, Inc. -

Empowered Collaborates with Harlequin Floors

Empowered Collaborates with Harlequin Floors -

Movie Premiere, TCL Chinese Theater

Movie Premiere, TCL Chinese Theater -

Studio Tech provides services for the Grammy House

Studio Tech provides services for the Grammy House -

Sora AI Text To Video

Sora AI Text To Video -

New Apex Photo Studios

New Apex Photo Studios

Website: Rent Smarter, Create More & earn rewards! -

-

How Ideal Sets Founder Harry Hou Cracked the Code on Affordable Standing Sets

How Ideal Sets Founder Harry Hou Cracked the Code on Affordable Standing Sets -

New Storage & Co-Working Spaces In Boyle Heights near Studios

New Storage & Co-Working Spaces In Boyle Heights near Studios

For Short or long term rental -

Auroris X Lands at A Very Good Space

Auroris X Lands at A Very Good Space -

GBH Maintenance Completes Work on 33000ft Production Space

GBH Maintenance Completes Work on 33000ft Production Space -

MUSICIAN ZIGGY MARLEY IS ANOTHER HAPPY.CUSTOMER OF MAILBOX TOLUCA LAKE'S 'DR. VOICE'

MUSICIAN ZIGGY MARLEY IS ANOTHER HAPPY.CUSTOMER OF MAILBOX TOLUCA LAKE'S 'DR. VOICE' -

Custom Digitally Printed Commencement Banners & Backdrops

Custom Digitally Printed Commencement Banners & Backdrops -

Rose Brand, SGM, Bill Sapsis, Sapsis Rigging, and Harlequin Floors Sponsor NATEAC Events

Rose Brand, SGM, Bill Sapsis, Sapsis Rigging, and Harlequin Floors Sponsor NATEAC Events -

Kitty Halftime Show air for Animal Planet's Puppy Bowl

Kitty Halftime Show air for Animal Planet's Puppy Bowl -

Georgia Animal Actors Persents Merlin

Georgia Animal Actors Persents Merlin -

ESTA Launches Revamped NATEAC Website

ESTA Launches Revamped NATEAC Website -

Mollie's Locations

Mollie's Locations -

ZEISS Cinema News for February

ZEISS Cinema News for February -

-

Seamless Fabric Backdrops up to 140ft x 16ft, Printed Floors...

Seamless Fabric Backdrops up to 140ft x 16ft, Printed Floors... -

Check out all the Pioneer Gear at Astro!

Check out all the Pioneer Gear at Astro! -

Production News & Events

Production News & Events -

All of Your Production Supplies Gathered in Just One Place

All of Your Production Supplies Gathered in Just One Place -

Meet the RED V-Raptor [X]

Meet the RED V-Raptor [X] -

Sit Back and Enjoy Some Laughs

Sit Back and Enjoy Some Laughs -

Mr. Location Scout Scouted and Managed Locations

Mr. Location Scout Scouted and Managed Locations -

Introducing...

Introducing...

Landmark Restaurant in Encino -

The White Owl Studio is celebrating all that is new!

The White Owl Studio is celebrating all that is new! -

-

Last Call for NATEAC 2024 Proposals

Last Call for NATEAC 2024 Proposals -

NOMINATIONS ANNOUNCED FOR THE

NOMINATIONS ANNOUNCED FOR THE

2024 MUAHS -

Voted Best New Stage Rigging Products at LDI 2023

Voted Best New Stage Rigging Products at LDI 2023 -

NEED MORE SPARKLE IN THE FLOOR?

NEED MORE SPARKLE IN THE FLOOR? -

David Panfili to Appoint Michael Paul as President of Location Sound Corp.

David Panfili to Appoint Michael Paul as President of Location Sound Corp.

industry news

The Latest Industry News for the Exciting World of Production.

Creative Handbook puts together a bi-monthly newsletter featuring

up-to-date information on events, news and industry changes.

Add My Email

California's Film and TV Tax Credit Program Extended for Five Years in Governor's Proposed Budget

January 12, 2023

Email This Article |  |

|

New Provisions Affirm California's Long-Term Commitment to Fighting 'Runaway Production' and Defending Its Status as the World's Media Production Capital

Hollywood, Calif. - January 10, 2023 - Governor Gavin Newsom's proposed 2023-24 state budget extends funding for California's Film and TV Tax Credit Program an additional five years (through fiscal 2030-31) and proposes to make credits refundable for the first time since the state launched its incentive in 2009.

The new budget provisions are part of Governor Newsom's ongoing effort to retain and grow production activity across the Golden State. They call for replacing the current third iteration of the state's tax credit program (Program 3.0), which sunsets in 2025, with a new five-year program dubbed Program 4.0. While total funding is proposed to remain at $330 million per year, tax credits awarded under Program 4.0 will be eligible to be partially refundable to make the program applicable to a broader range of applicants.

"The proposed budget affirms Governor Newsom's leadership in ensuring California's Film and TV Tax Credit Program evolves and continues to deliver on our goal of retaining and growing in-state production," said California Film Commission Executive Director Colleen Bell. "The five-year extension and provision to make tax credits refundable will give industry decision makers more options and the certainty they need to make long-term investments here in the Golden State. This will translate into more production-related jobs, spending and opportunity."

Refundable tax credits will enable applicants to claim a tax refund at a discounted value over multiple years. Credits used to offset in-state tax liability will continue to retain their full value. Under California's current program, credits for feature films and TV projects are non-refundable and non-transferable, while credits for independent film projects are currently transferable but non-refundable. With the proposed budget, all applicants (and therefore all projects) admitted into California's tax credit program could be eligible for refundable tax credits.

Building On a Record of Success

California has earned its long-held status as the world's film and TV production capital due to its superior crews, talent, infrastructure, weather, locations and a host of other factors that promote business and creative success. In recent years, aggressive incentives -- mostly in the form of tax credits and rebates -- have attempted to lure production away from the Golden State. The impact of such 'runaway production' prompted policymakers in California to respond with the state's own robust tax credit program.

According to the California Film Commission's latest progress report, the current iteration of the state's tax credit program (Program 3.0) launched in July 2020 and is on track to generate more than $6.2 billion in total production spending statewide during just the first half of its five-year duration. This figure includes $4.2 billion in "qualified" spending, defined as wages to below-the-line crew members and payments to in-state vendors. Only the qualified portion of each project's budget is eligible for tax credits under California's uniquely targeted program. The $6.2 billion figure does not include the creation/retention of non-incentivized jobs for performers, producers, directors, writers, composers and music supervisors.

A recent study by the Los Angeles Economic Development Corporation (LAEDC) reported that each dollar allocated by California's Film and TV Tax Credit Program generated $24.40 in economic output, plus $1.07 returned to taxpayers in state and local tax revenues.

In addition to bringing production jobs and spending to regions across the state, California's Film and TV Tax Credit Program also promotes workforce training, diversity and inclusion. The Career Readiness requirement mandates that all tax credit projects participate in learning and training programs such as paid internships for students, externships for faculty members, workshops, panels and professional skills tours. The more recently launched Career Pathways Program specifically targets individuals from underserved communities. It is funded directly by tax credit projects and works with partner training programs across the state to reduce the economic, geographic and social barriers to career success. California's tax credit program also requires participating projects to have a written policy for addressing unlawful harassment and submit voluntarily reported above and below-the-line cast and crew employment diversity data. Each production must also provide the state with a copy of its initiatives and programs to increase the representation of women and minorities.

A full summary of Governor Newsom's proposed 2023-24 state budget is available here and a revised proposal with revenue estimates will be released this May. The state's 2023-24 fiscal year begins July 1st.

About California's Film and Television Tax Credit Program

California's film and television production incentive was launched in 2009. In 2014, the California legislature passed a bill that created the second iteration of the state's tax credit program (Program 2.0) and more than tripled the amount of funding from $100 million to $330 million annually. Program 2.0 also extended eligibility to include a range of project types (big-budget feature films, TV pilots and 1-hr. TV series for any distribution outlet) that were excluded from the first-generation tax credit program. In addition, Program 2.0 introduced a "jobs ratio" ranking system to select projects based on "qualified" spending (e.g., wages paid to below-the-line workers and payments made to in-state vendors). To spur production statewide, a supplementary five percent tax credit was made available to non-independent projects that shoot outside the Los Angeles 30-Mile Studio Zone or that have qualified expenditures for visual effects or music scoring/track recording. The five-year Program 2.0 went into effect on July 1, 2015 and wrapped its fifth and final fiscal year (2019/20) on June 30, 2020.

The third (current) generation of the California Film and TV Tax Credit Program (dubbed "Program 3.0") was launched on July 1, 2020. New provisions included a pilot skills training program to help individuals from underserved communities gain access to career opportunities. Program 3.0 also added provisions requiring projects to have a written policy for addressing unlawful harassment and enhanced reporting of above and below-the-line cast and crew employment diversity data.

More information about California's Film and Television Tax Credit Program 3.0, including application procedures, eligibility, and guidelines, is available at http://www.film.ca.gov/tax-credit/.

Hollywood, Calif. - January 10, 2023 - Governor Gavin Newsom's proposed 2023-24 state budget extends funding for California's Film and TV Tax Credit Program an additional five years (through fiscal 2030-31) and proposes to make credits refundable for the first time since the state launched its incentive in 2009.

The new budget provisions are part of Governor Newsom's ongoing effort to retain and grow production activity across the Golden State. They call for replacing the current third iteration of the state's tax credit program (Program 3.0), which sunsets in 2025, with a new five-year program dubbed Program 4.0. While total funding is proposed to remain at $330 million per year, tax credits awarded under Program 4.0 will be eligible to be partially refundable to make the program applicable to a broader range of applicants.

"The proposed budget affirms Governor Newsom's leadership in ensuring California's Film and TV Tax Credit Program evolves and continues to deliver on our goal of retaining and growing in-state production," said California Film Commission Executive Director Colleen Bell. "The five-year extension and provision to make tax credits refundable will give industry decision makers more options and the certainty they need to make long-term investments here in the Golden State. This will translate into more production-related jobs, spending and opportunity."

Refundable tax credits will enable applicants to claim a tax refund at a discounted value over multiple years. Credits used to offset in-state tax liability will continue to retain their full value. Under California's current program, credits for feature films and TV projects are non-refundable and non-transferable, while credits for independent film projects are currently transferable but non-refundable. With the proposed budget, all applicants (and therefore all projects) admitted into California's tax credit program could be eligible for refundable tax credits.

Building On a Record of Success

California has earned its long-held status as the world's film and TV production capital due to its superior crews, talent, infrastructure, weather, locations and a host of other factors that promote business and creative success. In recent years, aggressive incentives -- mostly in the form of tax credits and rebates -- have attempted to lure production away from the Golden State. The impact of such 'runaway production' prompted policymakers in California to respond with the state's own robust tax credit program.

According to the California Film Commission's latest progress report, the current iteration of the state's tax credit program (Program 3.0) launched in July 2020 and is on track to generate more than $6.2 billion in total production spending statewide during just the first half of its five-year duration. This figure includes $4.2 billion in "qualified" spending, defined as wages to below-the-line crew members and payments to in-state vendors. Only the qualified portion of each project's budget is eligible for tax credits under California's uniquely targeted program. The $6.2 billion figure does not include the creation/retention of non-incentivized jobs for performers, producers, directors, writers, composers and music supervisors.

A recent study by the Los Angeles Economic Development Corporation (LAEDC) reported that each dollar allocated by California's Film and TV Tax Credit Program generated $24.40 in economic output, plus $1.07 returned to taxpayers in state and local tax revenues.

In addition to bringing production jobs and spending to regions across the state, California's Film and TV Tax Credit Program also promotes workforce training, diversity and inclusion. The Career Readiness requirement mandates that all tax credit projects participate in learning and training programs such as paid internships for students, externships for faculty members, workshops, panels and professional skills tours. The more recently launched Career Pathways Program specifically targets individuals from underserved communities. It is funded directly by tax credit projects and works with partner training programs across the state to reduce the economic, geographic and social barriers to career success. California's tax credit program also requires participating projects to have a written policy for addressing unlawful harassment and submit voluntarily reported above and below-the-line cast and crew employment diversity data. Each production must also provide the state with a copy of its initiatives and programs to increase the representation of women and minorities.

A full summary of Governor Newsom's proposed 2023-24 state budget is available here and a revised proposal with revenue estimates will be released this May. The state's 2023-24 fiscal year begins July 1st.

About California's Film and Television Tax Credit Program

California's film and television production incentive was launched in 2009. In 2014, the California legislature passed a bill that created the second iteration of the state's tax credit program (Program 2.0) and more than tripled the amount of funding from $100 million to $330 million annually. Program 2.0 also extended eligibility to include a range of project types (big-budget feature films, TV pilots and 1-hr. TV series for any distribution outlet) that were excluded from the first-generation tax credit program. In addition, Program 2.0 introduced a "jobs ratio" ranking system to select projects based on "qualified" spending (e.g., wages paid to below-the-line workers and payments made to in-state vendors). To spur production statewide, a supplementary five percent tax credit was made available to non-independent projects that shoot outside the Los Angeles 30-Mile Studio Zone or that have qualified expenditures for visual effects or music scoring/track recording. The five-year Program 2.0 went into effect on July 1, 2015 and wrapped its fifth and final fiscal year (2019/20) on June 30, 2020.

The third (current) generation of the California Film and TV Tax Credit Program (dubbed "Program 3.0") was launched on July 1, 2020. New provisions included a pilot skills training program to help individuals from underserved communities gain access to career opportunities. Program 3.0 also added provisions requiring projects to have a written policy for addressing unlawful harassment and enhanced reporting of above and below-the-line cast and crew employment diversity data.

More information about California's Film and Television Tax Credit Program 3.0, including application procedures, eligibility, and guidelines, is available at http://www.film.ca.gov/tax-credit/.

No Comments

Post Comment