-

Studio Tech Provides Wi-Fi And Internet for The Superman Movie Press Junket

Studio Tech Provides Wi-Fi And Internet for The Superman Movie Press Junket -

Superman movie Press Junket @ Buttercup Venues

Superman movie Press Junket @ Buttercup Venues -

Honoring Stories Worth Telling Since 2009

Honoring Stories Worth Telling Since 2009

All Ages - All Cultures - All Media -

Xenia Lappo Joins ESTA as New Program Manager for Membership & Events

Xenia Lappo Joins ESTA as New Program Manager for Membership & Events -

NOMINATIONS ANNOUNCED FOR THE LOCATION MANAGERS GUILD INTERNATIONAL AWARDS

NOMINATIONS ANNOUNCED FOR THE LOCATION MANAGERS GUILD INTERNATIONAL AWARDS -

Nathan Wilson and Chris Connors discuss creating for children's television with ZEISS Supreme Prime lenses

Nathan Wilson and Chris Connors discuss creating for children's television with ZEISS Supreme Prime lenses -

Luxury Solar Restroom Trailer Sustainability

Luxury Solar Restroom Trailer Sustainability -

Midwest Rigging Intensive Returns with Touring Rigging Theme

Midwest Rigging Intensive Returns with Touring Rigging Theme -

Westside Digital Mix: Venice Edition

Westside Digital Mix: Venice Edition -

Custom Prop Rentals: Bringing Your Dream Event to Life with Life-Size Magic

Custom Prop Rentals: Bringing Your Dream Event to Life with Life-Size Magic -

Custom Pool Floats That Steal the Show

Custom Pool Floats That Steal the Show -

Malibu Autobahn Dresses Coachella 2025 for Shoreline Mafia

Malibu Autobahn Dresses Coachella 2025 for Shoreline Mafia -

Thunder Studios Wins Nine 2025 Telly Awards

Thunder Studios Wins Nine 2025 Telly Awards -

-

LCW Props Is Your One Stop Prop Shop

LCW Props Is Your One Stop Prop Shop -

Venues in Los Angeles for Activations and Filming

Venues in Los Angeles for Activations and Filming -

-

-

Honoring Stories Worth Telling Since 2009 - All Ages - All Cultures - All Media

Honoring Stories Worth Telling Since 2009 - All Ages - All Cultures - All Media -

Buttercup Venues Accepting Submissions to Help Property Owners Monetize Their Spaces

Buttercup Venues Accepting Submissions to Help Property Owners Monetize Their Spaces -

Studio Animal Services Stars in Latest Fancy Feast Commercial

Studio Animal Services Stars in Latest Fancy Feast Commercial -

WDM celebrates Summer at the famed Michael's Santa Monica

WDM celebrates Summer at the famed Michael's Santa Monica -

Studio Technical Services Inc.

Studio Technical Services Inc.

Spring 2025 Newsletter -

From Call to Setup: Coffee House Industries Lights Up Netflix Is a Joke at the Avalon

From Call to Setup: Coffee House Industries Lights Up Netflix Is a Joke at the Avalon -

WLA3D produces scale model for Fox Grip

WLA3D produces scale model for Fox Grip -

Filming Locations and Event Venues Los Angeles

Filming Locations and Event Venues Los Angeles -

Scenic Expressions Launches a Full-Service Liquidation Solution for the Film & TV Industry

Scenic Expressions Launches a Full-Service Liquidation Solution for the Film & TV Industry -

Producers Need Reel Monster Trucks for Reel Productions

Producers Need Reel Monster Trucks for Reel Productions -

Meet Michael Way | Engineer

Meet Michael Way | Engineer -

In Development: ZEISS Virtual Lens Technology Elevating VFX with physically based lens effects

In Development: ZEISS Virtual Lens Technology Elevating VFX with physically based lens effects -

(2) PREMIER AV ACTIONS

(2) PREMIER AV ACTIONS -

RSVP - 80 Films & Tech - Meet the Visionaries - EMMY, Telly, Peabody winners and more

RSVP - 80 Films & Tech - Meet the Visionaries - EMMY, Telly, Peabody winners and more -

New Arrivals Are Here - Check Out LMTreasures.com

New Arrivals Are Here - Check Out LMTreasures.com -

Film-Friendly Retail Space at Tejon Outlets

Film-Friendly Retail Space at Tejon Outlets -

Behind Every Great Production, There's a Great Move

Behind Every Great Production, There's a Great Move -

Buttercup Venues' recent work with Invisible Dynamics & Blue Revolver

Buttercup Venues' recent work with Invisible Dynamics & Blue Revolver -

Join ZEISS Cinema at this year's NJ Film Expo on Thursday, May 1

Join ZEISS Cinema at this year's NJ Film Expo on Thursday, May 1 -

The Location Managers Guild International (LMGI) announces that its 12th Annual LMGI Awards Show will be held on Saturday, August 23, 2025

The Location Managers Guild International (LMGI) announces that its 12th Annual LMGI Awards Show will be held on Saturday, August 23, 2025 -

Get Your Production Supplies Now While Prices Are Stable*

Get Your Production Supplies Now While Prices Are Stable*

Rose Brand Is Your One Stop Shop -

Immersive Sound for your next production from TrueSPL

Immersive Sound for your next production from TrueSPL -

WeCutFoam Fabricating Large Scale Props and Decor for Companies & Products Launching Events

WeCutFoam Fabricating Large Scale Props and Decor for Companies & Products Launching Events -

The "CA-Creates" eGroup Network

The "CA-Creates" eGroup Network -

The Location Managers Guild International Announces the Newly Elected 2025 LMGI Board of Directors

The Location Managers Guild International Announces the Newly Elected 2025 LMGI Board of Directors -

Production Moves: How to Find the Most Qualified Mover

Production Moves: How to Find the Most Qualified Mover -

SAG-AFTRA Talent Payments @ Production Payroll Services

SAG-AFTRA Talent Payments @ Production Payroll Services -

-

-

New Everyday Low Prices on Rigging Hardware

New Everyday Low Prices on Rigging Hardware

Take a Look at 20% Lower Prices on Average -

Tejon Ranch introduces its Premium Ranch Cabins

Tejon Ranch introduces its Premium Ranch Cabins -

Our Enchanting Garden Collection is Growing!

Our Enchanting Garden Collection is Growing! -

-

-

Top Entertainment CEOs & Industry Titans Join Forces for Groundbreaking New Media Film Festival®

Top Entertainment CEOs & Industry Titans Join Forces for Groundbreaking New Media Film Festival® -

Tejon Ranch opens Diner location for your next Production

Tejon Ranch opens Diner location for your next Production -

Discover the Performance of ZEISS Otus ML

Discover the Performance of ZEISS Otus ML

Deep Dive into the Features and Technology -

Step and Repeat LA Enhances Printing Capabilities with HP Latex R1000 Plus Flatbed Printer

Step and Repeat LA Enhances Printing Capabilities with HP Latex R1000 Plus Flatbed Printer -

Universal Animals cast the dog in Anora!

Universal Animals cast the dog in Anora! -

Burbank Stages is Now Open with upgraded support space

Burbank Stages is Now Open with upgraded support space -

-

Buttercup Venues Grows Portfolio with Exciting New Locations for Filming and Events

Buttercup Venues Grows Portfolio with Exciting New Locations for Filming and Events -

Fashion District Suite 301

Fashion District Suite 301 -

Something new is coming for Photographers

Something new is coming for Photographers

Mark Your Calendar - February 25th -

WLA3D completes scale model of vintage Knott's Berry Farm attraction

WLA3D completes scale model of vintage Knott's Berry Farm attraction -

New Media Film Festival has invited you to submit your work via FilmFreeway!

New Media Film Festival has invited you to submit your work via FilmFreeway! -

WeCutFoam Collaborated Once More with Children's Miracle Network Hospitals

WeCutFoam Collaborated Once More with Children's Miracle Network Hospitals -

-

EigRig SLIDE-R1 Revolutionizes Filmmaking Production with Innovation

EigRig SLIDE-R1 Revolutionizes Filmmaking Production with Innovation -

-

-

-

Practicals Rental Lighting Welcomes the Jucolor UV Flatbed Printer

Practicals Rental Lighting Welcomes the Jucolor UV Flatbed Printer -

GBH Maintenance Inc. Has Grown

GBH Maintenance Inc. Has Grown -

The Rarest Stars Shine Brightest

The Rarest Stars Shine Brightest -

Affected by the ongoing California wildfires

Affected by the ongoing California wildfires -

Get One-Stop Shopping...

Get One-Stop Shopping... -

Buttercup Venues Expands

Buttercup Venues Expands -

-

Los Angeles Office Spaces: Versatile Backdrops for Filming

Los Angeles Office Spaces: Versatile Backdrops for Filming -

All Creatures Great and small holiday commercial for Montefiore hospital

All Creatures Great and small holiday commercial for Montefiore hospital -

DEEP CLEANS WAREHOUSE FOR SUPER BOWL COMMERCIAL

DEEP CLEANS WAREHOUSE FOR SUPER BOWL COMMERCIAL -

New Production Hub in Los Angeles

New Production Hub in Los Angeles -

Carlos R. Diazmuñoz

Carlos R. Diazmuñoz -

The Secret Behind Hollywood Premieres

The Secret Behind Hollywood Premieres -

WeCutFoam Specializes in Decor

WeCutFoam Specializes in Decor -

Studio Technical Services Inc.

Studio Technical Services Inc.

Fall 2024 Update -

New Media Film Festival has invited you to submit your work

New Media Film Festival has invited you to submit your work -

-

Available again!

Available again!

Studio 301 - 16,000 Sq. Ft. -

Elevate Your Production with SoundPressure Labs'

Elevate Your Production with SoundPressure Labs' -

Pro-Cam expands rental operation...

Pro-Cam expands rental operation... -

NATIONAL ASSOCIATION OF LATINO INDEPENDENT PRODUCERS

NATIONAL ASSOCIATION OF LATINO INDEPENDENT PRODUCERS -

New Sony A9 III Reviews

New Sony A9 III Reviews -

New, Heavyweight, Lustrous, Shimmering 56" Elana IFR Fabric

New, Heavyweight, Lustrous, Shimmering 56" Elana IFR Fabric -

JOIN US IN ORLANDO THIS NOVEMBER!

JOIN US IN ORLANDO THIS NOVEMBER! -

BLUE MOON CLEANING

BLUE MOON CLEANING

RESTORES MUSIC-MAKING -

Another Collaboration Between WeCutFoam and Event Planner

Another Collaboration Between WeCutFoam and Event Planner -

BLUE MOON CONGRATULATES 2024 COLA FINALISTS

BLUE MOON CONGRATULATES 2024 COLA FINALISTS -

Fall Production News & Events

Fall Production News & Events -

Not just green, but mighty Verde

Not just green, but mighty Verde -

Introducing...

Introducing...

Restaurant/Bar/Venue in Encino -

-

ESTA and Earl Girls, Inc. Launch $100,000 TSP Fundraising Challenge

ESTA and Earl Girls, Inc. Launch $100,000 TSP Fundraising Challenge -

There's still time to register for ESTA's Plugfest

There's still time to register for ESTA's Plugfest -

-

BLUE MOON CLEANING SEES SPIKE IN MAJOR LA FEATURE FILMING

BLUE MOON CLEANING SEES SPIKE IN MAJOR LA FEATURE FILMING -

"The Secret Behind Hollywood Premieres"

"The Secret Behind Hollywood Premieres" -

Amoeba Records on Sunset

&

SuperMarket in K-Town -

"Alice in Wonderland" tea party brought to life...

"Alice in Wonderland" tea party brought to life... -

Filming With Production Ready Aviation Equipment

Filming With Production Ready Aviation Equipment -

-

-

A5 Events - Take Your Event to The Next Level

A5 Events - Take Your Event to The Next Level -

The Original Amoeba Records Venue

The Original Amoeba Records Venue

& The SuperMarket -

Doc Filmmaker Jennifer Cox

Doc Filmmaker Jennifer Cox -

Red, White or Blue Rental Drapes

Red, White or Blue Rental Drapes -

Introducing Tuck Track Invisible Framing for Fabric Prints

Introducing Tuck Track Invisible Framing for Fabric Prints -

-

American Movie Company's LED Wall Studio Sale

American Movie Company's LED Wall Studio Sale -

Black 360 Independence Studio

Black 360 Independence Studio -

Nominations are open for the 2025 ESTA Board of Directors!

Nominations are open for the 2025 ESTA Board of Directors! -

Custom Prop Rentals is moving to a new, larger location!

Custom Prop Rentals is moving to a new, larger location! -

Jazz Up Your Event with the Custom Embrace Display

Jazz Up Your Event with the Custom Embrace Display -

Pro-Cam opens Las Vegas branch, expanding rental operation

Pro-Cam opens Las Vegas branch, expanding rental operation -

New ShowLED Starlight Drops

New ShowLED Starlight Drops -

Costume House Sidewalk Sale

Costume House Sidewalk Sale -

Working Wildlife's newly renovated 60 acre ranch available for Filming

Working Wildlife's newly renovated 60 acre ranch available for Filming -

Location Manager Bill Bowling

Location Manager Bill Bowling

to Receive the Trailblazer Award -

-

Mr. Location Scout is in Lake Tahoe

Mr. Location Scout is in Lake Tahoe -

DreamMore Resort Fountain

DreamMore Resort Fountain -

Valley Film Festival

Valley Film Festival

Greetings from the (818): -

2024 Changemaker Awards and Artist Development Showcase

2024 Changemaker Awards and Artist Development Showcase -

ZEISS Conversations with Jack Schurman

ZEISS Conversations with Jack Schurman -

Collaboration Between WeCutFoam and Yaamava Resort & Casino

Collaboration Between WeCutFoam and Yaamava Resort & Casino -

Location Managers Guild International Awards

Location Managers Guild International Awards -

Molding Cloth

Molding Cloth

Make Fabulous Textured Designs -

WeCutFoam Specializes in Large Events

WeCutFoam Specializes in Large Events -

Introducing Truck Track Invisible Framing for Fabric Prints

Introducing Truck Track Invisible Framing for Fabric Prints -

GBH Maintenance is back at Herzog Wine Cellars

GBH Maintenance is back at Herzog Wine Cellars -

SATE NORTH AMERICA 2024

SATE NORTH AMERICA 2024 -

Production News & Events Summer Edition

Production News & Events Summer Edition -

Four Amazing Architectural Locations!

Four Amazing Architectural Locations! -

* BIG SAVINGS * ON BIG STUDIOS

* BIG SAVINGS * ON BIG STUDIOS -

Let Your Brand Stand Tall!

Let Your Brand Stand Tall! -

Sue Quinn to Receive Lifetime Achievement Award

Sue Quinn to Receive Lifetime Achievement Award -

ZEISS Cinema at Filmscape Chicago

ZEISS Cinema at Filmscape Chicago -

GBH Maintenance Is the Standard for Commercial Maintenance

GBH Maintenance Is the Standard for Commercial Maintenance -

Come Join Us at Cine Gear Expo 2024

Come Join Us at Cine Gear Expo 2024 -

Available now:

Available now:

6th Street Gallery & Venue -

Thunder Studios Triumphs with Five Telly Awards

Thunder Studios Triumphs with Five Telly Awards -

Reddit Went Public IPO - WeCutFoam Was There With Decor

Reddit Went Public IPO - WeCutFoam Was There With Decor -

AirDD's Hottest New Product

AirDD's Hottest New Product

for 2024 Events -

GBH Maintenance Sets the Standard for Window Cleaning

GBH Maintenance Sets the Standard for Window Cleaning -

Haigwood Studios collaboration with the UGA Dodd School of Art

Haigwood Studios collaboration with the UGA Dodd School of Art -

-

RX GOES TO 11!

RX GOES TO 11!

with Mike Rozett -

Don't Be A Square - Think Outside The Box!!

Don't Be A Square - Think Outside The Box!! -

WeCutFoam Fabricates Realistic Lifesize Props

WeCutFoam Fabricates Realistic Lifesize Props -

-

Exposition Park Stage/Venue

Exposition Park Stage/Venue -

Production Update From UpState California Film Commission

Production Update From UpState California Film Commission -

Base Camp With All The Extras

Base Camp With All The Extras -

LAPPG AT THE ZEISS CINEMA SHOWROOM

LAPPG AT THE ZEISS CINEMA SHOWROOM -

ZEISS Nano Primes and ZEISS CinCraft Scenario Received NAB Show 2024

ZEISS Nano Primes and ZEISS CinCraft Scenario Received NAB Show 2024 -

Cranium Camera Cranes Introduces the all new Tankno Crane!

Cranium Camera Cranes Introduces the all new Tankno Crane! -

Come Join Us at Cine Gear Expo 2024

Come Join Us at Cine Gear Expo 2024 -

FAA Drill Burbank Airport

FAA Drill Burbank Airport

(federal aviation administration) -

Exclusive Stahl Substitute Listing from Toni Maier-On Location, Inc.

Exclusive Stahl Substitute Listing from Toni Maier-On Location, Inc. -

GBH Maintenance: Elevating Janitorial Standards Across Los Angeles

GBH Maintenance: Elevating Janitorial Standards Across Los Angeles -

LOCATION CONNECTION has the best RANCHES FOR FILMING!

LOCATION CONNECTION has the best RANCHES FOR FILMING! -

Hollywood Studio Gallery has Moved

Hollywood Studio Gallery has Moved -

AirDD's inflatable "Kraken" designs transformed Masked Singers

AirDD's inflatable "Kraken" designs transformed Masked Singers -

GBH maintenance Provided a Hollywood Shine for Herzog Wine Cellars

GBH maintenance Provided a Hollywood Shine for Herzog Wine Cellars -

Production News & Events

Production News & Events

Spring Newsletter -

Immersive Venue/ Black Box/ Stage

Immersive Venue/ Black Box/ Stage

2024 DTLA Arts District -

-

Exclusive Malibu Listing from Toni Maier - On Location, Inc.

Exclusive Malibu Listing from Toni Maier - On Location, Inc. -

Empowered Collaborates with Harlequin Floors

Empowered Collaborates with Harlequin Floors -

Movie Premiere, TCL Chinese Theater

Movie Premiere, TCL Chinese Theater -

Studio Tech provides services for the Grammy House

Studio Tech provides services for the Grammy House -

Sora AI Text To Video

Sora AI Text To Video -

New Apex Photo Studios

New Apex Photo Studios

Website: Rent Smarter, Create More & earn rewards! -

-

How Ideal Sets Founder Harry Hou Cracked the Code on Affordable Standing Sets

How Ideal Sets Founder Harry Hou Cracked the Code on Affordable Standing Sets -

New Storage & Co-Working Spaces In Boyle Heights near Studios

New Storage & Co-Working Spaces In Boyle Heights near Studios

For Short or long term rental -

Auroris X Lands at A Very Good Space

Auroris X Lands at A Very Good Space -

GBH Maintenance Completes Work on 33000ft Production Space

GBH Maintenance Completes Work on 33000ft Production Space -

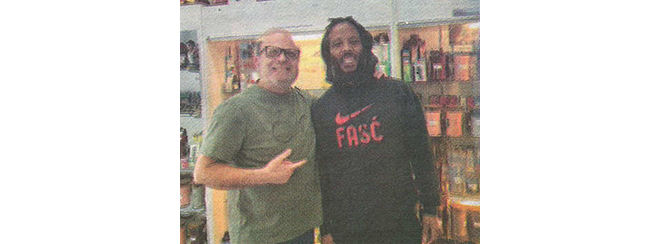

MUSICIAN ZIGGY MARLEY IS ANOTHER HAPPY.CUSTOMER OF MAILBOX TOLUCA LAKE'S 'DR. VOICE'

MUSICIAN ZIGGY MARLEY IS ANOTHER HAPPY.CUSTOMER OF MAILBOX TOLUCA LAKE'S 'DR. VOICE' -

Custom Digitally Printed Commencement Banners & Backdrops

Custom Digitally Printed Commencement Banners & Backdrops -

Rose Brand, SGM, Bill Sapsis, Sapsis Rigging, and Harlequin Floors Sponsor NATEAC Events

Rose Brand, SGM, Bill Sapsis, Sapsis Rigging, and Harlequin Floors Sponsor NATEAC Events -

Kitty Halftime Show air for Animal Planet's Puppy Bowl

Kitty Halftime Show air for Animal Planet's Puppy Bowl -

Georgia Animal Actors Persents Merlin

Georgia Animal Actors Persents Merlin -

ESTA Launches Revamped NATEAC Website

ESTA Launches Revamped NATEAC Website -

Mollie's Locations

Mollie's Locations -

ZEISS Cinema News for February

ZEISS Cinema News for February -

-

Seamless Fabric Backdrops up to 140ft x 16ft, Printed Floors...

Seamless Fabric Backdrops up to 140ft x 16ft, Printed Floors... -

Check out all the Pioneer Gear at Astro!

Check out all the Pioneer Gear at Astro! -

Production News & Events

Production News & Events -

All of Your Production Supplies Gathered in Just One Place

All of Your Production Supplies Gathered in Just One Place -

Meet the RED V-Raptor [X]

Meet the RED V-Raptor [X] -

Sit Back and Enjoy Some Laughs

Sit Back and Enjoy Some Laughs -

Mr. Location Scout Scouted and Managed Locations

Mr. Location Scout Scouted and Managed Locations -

Introducing...

Introducing...

Landmark Restaurant in Encino -

The White Owl Studio is celebrating all that is new!

The White Owl Studio is celebrating all that is new! -

-

Last Call for NATEAC 2024 Proposals

Last Call for NATEAC 2024 Proposals -

NOMINATIONS ANNOUNCED FOR THE

NOMINATIONS ANNOUNCED FOR THE

2024 MUAHS -

Voted Best New Stage Rigging Products at LDI 2023

Voted Best New Stage Rigging Products at LDI 2023 -

NEED MORE SPARKLE IN THE FLOOR?

NEED MORE SPARKLE IN THE FLOOR? -

David Panfili to Appoint Michael Paul as President of Location Sound Corp.

David Panfili to Appoint Michael Paul as President of Location Sound Corp.

industry news

The Latest Industry News for the Exciting World of Production.

Creative Handbook puts together a bi-monthly newsletter featuring

up-to-date information on events, news and industry changes.

Add My Email

California Film Commission Accepts Record Number of Tax Credit Applications

June 4, 2013

Hollywood, Calif. -- June 4, 2013 -- On Monday, June 3rd, the California Film Commission began accepting applications for the next $100 million round of tax credits provided annually by the state's Film & Television Tax Credit Program, which was enacted in 2009 to help curb runaway production.

The number of applications submitted this year on the first day of the application period rose 18 percent to 380, compared to 322 applications last year. At the same time, the total number of projects selected to receive a share of the $100 million in annual tax credits remained nearly steady at 31, from 28 projects last year*. Tax credits are reserved for each selected film and TV project based on the project's budget. Once the total sum of credits allocated reaches $100 million, any additional projects are placed on a waiting list.

Applications were accepted yesterday (June 3rd) from 9:00 am - 3:00 pm. At 3:30 pm, Film Commission staff members, with assistance from a Cal Fire deputy state fire marshal, conducted a lottery to select projects at random. Each application was given a number between 1 and 380, and the credits were then reserved in that order until all $100 million was assigned.

"The record number of applications this year serves as affirmation that the production industry wants to stay at home in California," said California Film Commission Executive Director Amy Lemisch. "But tax credits now drive much of the decision making process, and sadly many projects that weren't selected to receive California credits will be shot elsewhere."

Lemisch went on to explain how the industry has embraced California's tax credit program, as demonstrated by year-to-year growth in the number of applications submitted. Prior to this year's 18 percent increase, the number of applications received last year (on June 1, 2012) rose more than 80 percent to 322, compared to 176 the prior year.

The breakdown in type of projects selected this year is as follows**:

- Feature Films: 14 projects (2 studio / 12 independent)

- TV Series: 12 projects***

- Relocating TV Series: 2 projects

- MOW: 3 projects (1 studio / 2 independent)

- Mini-Series: 0

Across all categories, the dispersion among the initial 31 projects conditionally approved for tax credits was 17 studio projects and 14 indies.

Based on information provided by each applicant, it is estimated that these projects will spend more than $771 million in California, including more than $290 million in qualified wages. They will employ an estimated 2,980 cast members, 3,730 crew members and 80,680 extras/stand-ins (calculated in "man-days").

The California Film Commission will continue to accept tax credit program applications throughout the fiscal year (July 1, 2013 - June 30, 2014) for placement on the waiting list. Those on the list will be accepted only after credits are freed up by other projects that withdraw from the program due to scheduling delays or other production-related issues.

"In prior years, many projects on the waiting list ultimately received credits, and we expect that to be the case again this year," Lemisch added.

With the addition of the latest round of projects, California's Film & Television Tax Credit Program (enacted in 2009) is responsible for helping generate $4.67 billion in direct spending within the state, including $1.59 billion in wages paid to "below-the-line" crew members.

ABOUT THE CALIFORNIA FILM & TELEVISION TAX CREDIT PROGRAM

The California Film & Television Tax Credit Program was enacted in February 2009 as part of a targeted economic stimulus package to increase production spending, jobs and tax revenues in California. Administered by the California Film Commission, the program is targeted specifically at the types of productions most likely to leave California due to incentives offered by other states and countries. More information about the program is available at http://film.ca.gov/Incentives.htm.

ABOUT THE CALIFORNIA FILM COMMISSION

The California Film Commission (CFC) enhances California's status as the leader in motion picture, television and commercial production. It supports productions of all sizes and budgets, and focuses on activities that stimulate and preserve production spending, jobs and tax revenues in California. Services include administration of the state's Film & Television Tax Credit Program, permits for filming at state-owned facilities, an extensive digital location library, location assistance and a range of other production-related resources and assistance. More information is available at http://www.film.ca.gov.

* While 28 projects were selected via the lottery in 2012, a total of 75 projects ultimately received tax credits as part of last year's allocation. This was due to the number of smaller independent projects that went from the waiting list to receive credits

** Applications for this year's tax credit allocation are still being reviewed. Program statistics are subject to change.

*** Per tax credit statute, the "TV Series" category is limited to basic cable series.

The number of applications submitted this year on the first day of the application period rose 18 percent to 380, compared to 322 applications last year. At the same time, the total number of projects selected to receive a share of the $100 million in annual tax credits remained nearly steady at 31, from 28 projects last year*. Tax credits are reserved for each selected film and TV project based on the project's budget. Once the total sum of credits allocated reaches $100 million, any additional projects are placed on a waiting list.

Applications were accepted yesterday (June 3rd) from 9:00 am - 3:00 pm. At 3:30 pm, Film Commission staff members, with assistance from a Cal Fire deputy state fire marshal, conducted a lottery to select projects at random. Each application was given a number between 1 and 380, and the credits were then reserved in that order until all $100 million was assigned.

"The record number of applications this year serves as affirmation that the production industry wants to stay at home in California," said California Film Commission Executive Director Amy Lemisch. "But tax credits now drive much of the decision making process, and sadly many projects that weren't selected to receive California credits will be shot elsewhere."

Lemisch went on to explain how the industry has embraced California's tax credit program, as demonstrated by year-to-year growth in the number of applications submitted. Prior to this year's 18 percent increase, the number of applications received last year (on June 1, 2012) rose more than 80 percent to 322, compared to 176 the prior year.

The breakdown in type of projects selected this year is as follows**:

- Feature Films: 14 projects (2 studio / 12 independent)

- TV Series: 12 projects***

- Relocating TV Series: 2 projects

- MOW: 3 projects (1 studio / 2 independent)

- Mini-Series: 0

Across all categories, the dispersion among the initial 31 projects conditionally approved for tax credits was 17 studio projects and 14 indies.

Based on information provided by each applicant, it is estimated that these projects will spend more than $771 million in California, including more than $290 million in qualified wages. They will employ an estimated 2,980 cast members, 3,730 crew members and 80,680 extras/stand-ins (calculated in "man-days").

The California Film Commission will continue to accept tax credit program applications throughout the fiscal year (July 1, 2013 - June 30, 2014) for placement on the waiting list. Those on the list will be accepted only after credits are freed up by other projects that withdraw from the program due to scheduling delays or other production-related issues.

"In prior years, many projects on the waiting list ultimately received credits, and we expect that to be the case again this year," Lemisch added.

With the addition of the latest round of projects, California's Film & Television Tax Credit Program (enacted in 2009) is responsible for helping generate $4.67 billion in direct spending within the state, including $1.59 billion in wages paid to "below-the-line" crew members.

ABOUT THE CALIFORNIA FILM & TELEVISION TAX CREDIT PROGRAM

The California Film & Television Tax Credit Program was enacted in February 2009 as part of a targeted economic stimulus package to increase production spending, jobs and tax revenues in California. Administered by the California Film Commission, the program is targeted specifically at the types of productions most likely to leave California due to incentives offered by other states and countries. More information about the program is available at http://film.ca.gov/Incentives.htm.

ABOUT THE CALIFORNIA FILM COMMISSION

The California Film Commission (CFC) enhances California's status as the leader in motion picture, television and commercial production. It supports productions of all sizes and budgets, and focuses on activities that stimulate and preserve production spending, jobs and tax revenues in California. Services include administration of the state's Film & Television Tax Credit Program, permits for filming at state-owned facilities, an extensive digital location library, location assistance and a range of other production-related resources and assistance. More information is available at http://www.film.ca.gov.

* While 28 projects were selected via the lottery in 2012, a total of 75 projects ultimately received tax credits as part of last year's allocation. This was due to the number of smaller independent projects that went from the waiting list to receive credits

** Applications for this year's tax credit allocation are still being reviewed. Program statistics are subject to change.

*** Per tax credit statute, the "TV Series" category is limited to basic cable series.

Email This Article | Print This Article

No Comments

Post Comment